Finding product-market fit: How to define, measure and evolve your "North Star Metric"

How a 60% loss of ARR in one month taught me the importance of implementing a North Start Metric, and why revenue is a poor choice for measuring product-market fit.

👋 Hi, I’m Lars. “Finding Distribution” is a weekly newsletter with tactics for start-ups to build product traction 🚀 and generate revenue💰. I’m writing it based on my lessons learned from building two start-ups, and the greatness of other companies that I come across.

It was February 2020. Covid had hit the world, and stock markets had started to tank. Within less than four weeks, 60% of our company’s ARR was gone. 💸

💥 Poof. Evaporated into thin air.

Monthly renewals canceled immediately, and then as luck had it, we had a few larger annual contracts come up for renewal. Or so we thought.

Customers had given our company’s product the boot. We offered a data observability solution for cloud warehouses like Amazon Redshift. A hot market. Yet here we were, with little to show.

Strangely enough though, after placing frantic calls to the remaining 40% of our ARR, those customers told us how they had ZERO intention to go anywhere. In fact, one of our customers was a unicorn founder, and he told me adamantly how he wanted to invest into our next round.

There was a clear disconnect between these two customer segments - one running towards us, the other one running away as fast as possible.

That disconnect taught me about the importance of finding a metric that’s predictive of your company’s success, aka a “North Star Metric”.

Clearly, for us, that North Star Metric wasn’t revenue.

But if it’s not revenue, what is it? That’s what this post is about

What’s a North Star Metric and why do I need one?

Let’s start with the “what” and the “why”.

You will find plenty of content on North Star Metrics at the various product analytics companies - Heap, Mixpanel, Amplitude, PostHog, etc.

Here’s a great definition from Mark Simborg at Mixpanel:

A North Star metric is the one measurement that’s most predictive of a company’s long-term success.

I put “predictive” in bold, because that’s the key part.

Revenue is a bad North Star Metric because it’s a lagging indicator. If you pick revenue as your North Star Metric, then that’s exactly what you’ll get.

So why is that a problem? You may have heard of “Goodhart’s Law”, which roughly states how individuals will optimize their actions to achieve the desired outcome. For example, if an employee is incentivized on the number of cars sold each month, they will try to sell more cars, even at a loss. Founders can be extremely talented at closing the first 10-20 deals to get revenue. Any revenue, that is.

Turns out there can be such a thing as “bad” revenue, when customers do not receive sufficient value from your product. Bad revenue will lead to churn down the road. Like the 60% churn within a month in our case.

Don’t get me wrong. Achieving $500K-$1MM ARR of founder-led sales is a huge accomplishment, and the cash most definitely is nice. But it just isn’t an indicator for product-market fit - yet.

The infamous “Triple, triple, double, double, double” did more harm than good. Everyone started obsessing about revenue. People forgot about the first step in that post - which is establishing a great product-market fit.

And that’s the “why” of a North Star Metric. You need a NSM that can measure forward-looking product-market fit, i.e. a leading indicator.

The “aha” moment in the customer journey

The first step is defining your NSM is to discover an “aha!” moment in your customer’s journey.

An “aha” moment is “the interaction that fills users with a feeling of delight and reveals the true value of the product to them,”

as Lynsey Duncan, a product researcher at Intercom, writes.

The common perception is that an “aha” moment occurs when someone starts using a product. Lynn demonstrates how timing of “aha” moments can be quite different - they can happen before sign-up to a product, or after using it for quite a while.

Individual “aha” moments - the Docker example

To give you an example of an “aha” moment that occurs before actual product usage, let’s pick the nerdiest one I can think of - Solomon Hyke’s presentation at PyCon in March 2013.

In his 5-min talk “The Future of Linux containers”, he presents Docker, an open source project he invented. I’ll spare you the details on Linux containers, just know they are important, but also a pain to deal with, until Docker came along and made it easy.

Watch from 3:01 onwards, how he uses the command line interface to run a Docker container to print “hello word” in the terminal. Wait for the reaction of the audience at 3:44, when the whole room starts clapping. For a command line interface.

No one at this point had used Docker. But to the audience in the room it was obvious how much pain Docker was removing, and how much value they were receiving. The presentation was their “aha” moment.

How did that work out for Docker? Quite well, at least from a popularity perspective. Docker containers became an industry standard.

A Google Trends plot shows how interest in “Docker” the search term (blue line) picked up in April 2013, right after the talk. I compared it to “cloud computing” to give you a relative impression of Docker’s popularity.

Committee “aha” moments

The individual “aha” moment is crucial for initial product adoption. There’s a set of features that enables that moment. Reality in B2B sales though is that most software gets purchased by a committee. You end up with needing “aha” moments for each persona within the committee.

In her phenomenal guest post “Five steps to starting your product-led growth motion”on

by , Hila plots the various committee "aha" moments.These committee “aha” moments are so important because you’ll likely need all four of them. Lose one, and your deal is toast.

The people on the committee will ask “Why this product? Why now?”. If the answer isn’t super crisp and connected to your value prop, then your deal lacks urgency. Odds are they’ll punt to the next quarter.

Zuora famously created urgency for each buyer persona involved in purchasing a subscription billing solution. There’s an “aha” moment in there for everyone involved, as Andy Raskin describes in “Tailoring Your Pitch for Multiple Audiences.”

The full Zuora 56-page deck (different from the famous sales deck) with the slides above and more for detail each persona is available on Slideshare.

Turning your aha moment into a North Star Metric

An “aha” moment needs to turn into a habit - a set of behaviors indicative of repeated product usage. Product managers will often talk about “activating” a user. By measuring these behaviors in your product, we can turn our aha moment into a North Star metric.

Picking a good North Star Metric

A few examples of North Star Metrics:

AirBnB: Number of nights booked

Medium: Total time users spend reading content

Salesforce: Number of records stored

Amplitude: Number of weekly querying users

You can see from these metrics how they’re all product-related. Revenue is an outcome.

I took these example metrics from a talk by Rachel Bethany, a Director of Customer Success at Amplitude. In her talk, Bethany shows how a good North Star Metric has three components:

Value: Reflects how the customer benefits from your product

Leading Indicator: Measures engagement predictive of usage and leads to revenue

Strategy: Aligns with your company’s vision, goals and differentiators

Amplitude is the only public product analytics company. Not surprising, they’ve published a lot of work on North Star Metrics.

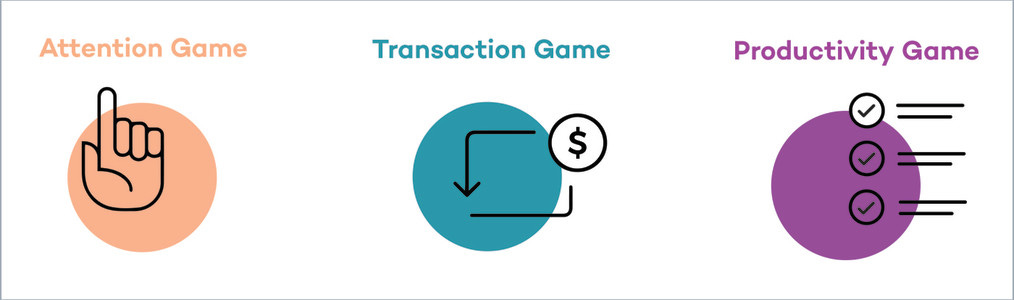

You’ll see in Bethany’s talk how Amplitude thinks about North Star Metrics in the context of the “game you’re playing”, with three different types of games and what industry verticals you’ll likely find them in:

Attention game: Maximize the amount of time customers spend in your product (media, entertainment, ad platforms)

Transaction game: Help customers make confident purchase decisions (marketplaces, eCommerce)

Productivity game: Deliver an easy way to execute complex tasks and workflows (B2B software)

Defining your North Star Metric is the result of a process, and the details go beyond this post.

But if you’re looking for epic reads with detailed “how-tos”, I recommend two sources:

“The Power of a Proper North Star Metric” by Buckley Barlow at Rocketsource.

How to measure your North Star Metric

You can now track your North Star Metric on a daily / monthly / quarterly cadence.

However, that ignores a few dimensions, such as the percentage of new customers that qualifies for reaching the metric, the time it takes them, and comparison over different months and customer cohorts. You need those dimensions, otherwise you don’t know if you’re improving.

Mark Roberge was the first CRO at Hubspot, and is now an investor at Stage 2 Capital. While at Hubspot, he developed a playbook for sales success. Part of this playbook includes using the North Star Metric as the leading indictor to measure product-market fit.

I recommend watching his talk “A Step by Step Guide to Revenue Growth”, because it’s full of actionable tips on how to operationalize your North Star Metric.

Mark has developed a formula that uses the North Star Metric as the leading indicator for product-market fit:

[Customer Success Leading Indicator] is “True” if P% of customers achieve E event(s) within T time.

E is the sequence of events that represents the leading indicator.

P is the percentage of customers that achieve the leading indicator.

T is the time it takes a user to accomplish the event

The result of that formula is the slide below with a cohort analysis, which Mark prescribes as “the first slide in any board deck.”

Let’s decompose how to read the slide, there are quite a few dimensions at play.

The rows are the monthly cohorts and indicate how many new customers were required in a calendar month.

Each month is indexed as “Month 1”, so that cohorts are normalized on a monthly basis.

The percentage in the cells indicates what share of the new customers acquired in Month 1 has reached customer success, i.e. product-market fit.

So how is our imaginary company we see on the slide doing? Pretty good, as the numbers show.

The number of new customers acquired is going up month-over-month, from 24 in January to 49 in December.

Within a year, the percentage of customers that achieve customer value in Month 1 has tripled from 3% in January to 9% in December.

Even better, after eleven months, for the November cohort, the percentage of customers that achieve customer value is 73%. Compare that to the January cohort, where after twelve months only 56% of customers have achieved customer value.

The imaginary company has gotten better at acquiring new customers in a given month, and helping new customers achieve value (our North Star Metric) faster. Clearly, product, product marketing, sales and customer success have figured out how to find their ideal customer, and convert them from prospects to engaged users of the product. If I saw this slide as an investor, I would ask “where can I send the check?”

Watch Mark’s more detailed explanation, it starts six minutes into the talk, or read this in-depth blog post “The Science of Re-Establishing Growth: When and How Fast?”

How to evolve your North Star Metric

As the business grows and evolves, so should your North Star Metric, to better reflect how your product delivers value.

Take Outreach, a sales execution platform. In a LinkedIn post, CEO and founder Manny Medina documents how at $20M in revenue, the Outreach North Star Metric became “Daily Active Users with a Sales Positive Motion”.

As you can see from the post, the NSM measured in detail how a customer reached customer success, and what sequence of events in the product are required. Eventually, as growth goals shifted and the platform offered more features, Outreach also evolved its NSM.

Another example is Snyk, a security company that helps developers detect vulnerabilities in their code. A good way to measure customer value is to track if a developer actually goes through the effort of fixing a vulnerability that Sny detects.

Ben Williams was the VP of Product at Snyk. In this interview on

, Ben shares how Snyk changed its NSM from an individual to a committee NSM.“Something we’re increasingly focused on from a product standpoint is the number of Weekly Fixing Orgs. This is defined as the number of teams who use Snyk to fix vulnerabilities in their code each week.”

“Aligning our North Star to org based (or team based) metrics rather than user based metrics is important for Snyk, since we are ultimately enabling teams to secure the applications they create.”

There’s more gold in various interviews with Ben, and I recommend searching for podcasts and videos with Ben.

Two examples:

Fireside Chat with Snyk’s Guy Podjarny and Ben Williams with Wei Lien Dan and Sandhya Hegde from Unusual Ventures.

How Snyk built a product-led growth juggernaut with

Lessons learned

For seed stage start-ups, revenue is a poor choice to measure product-market fit. Revenue is a lagging indicator that’s not indicative of success. Rather, look for “aha” moments in your customer experience, and learn how to identify a sequence of events that is predictive for recurring usage. There are individual and committee “aha” moments, and you need both to close deals.

A good North Star Metric measures customer value, is predictive of future customer success, and aligns with company goals and objectives. Revenue is an outcome of a good North Star Metric. North Star Metrics will evolve over time, as company goals and the value customers receive from a product change.

A good way to measure your NSM and track progress is a cohort analysis. Product analytics tools like Amplitude, Mixpanel, Heap or PostHog all offer this functionality.

<END>

If you’re finding this newsletter valuable, consider sharing it with friends, or subscribing if you haven’t already.

And best of luck for those trying to find distribution this week!

Lars ✌️